Share CFD trading

Trade Share CFDs of the largest companies across the US, UK, Asia, Australia and Europe with competitive spreads and fast execution.

FP Markets offers one of the most extensive trading suites in the industry, with access to over 10,000 Share CFDs, including the world’s largest companies by market capitalisation such as Microsoft, Apple, Nvidia, Meta, Alphabet, and many more.

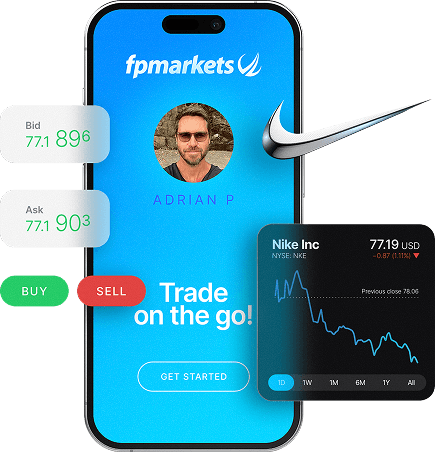

Choose from six powerful trading platforms – MetaTrader 4, MetaTrader 5, cTrader, TradingView, Iress and Mottai – all fully compatible across desktop and mobile, so you can trade anytime, anywhere.

All FP Markets trading accounts have been designed with the modern trader in mind. Empower your investing with access to thousands of financial instruments, advanced trading tools, competitive trading conditions, and multilingual customer support.

How to buy and sell Share CFDs

Access 800+ Share CFDs

Mobile app (iOS & Android)

Global trading community support

Access 800+ Share CFDs

Mobile app (iOS & Android)

Intuitive & user-friendly interface

Access 800+ Share CFDs

Web based

Fully cloud-based with advanced charting tools

Access 10,000+ Share CFDs

Mobile App (iOS & Android)

Advanced trading tools

Access 10,000+ Share CFDs

Mobile App (iOS & Android)

DMA CFD trading model

Iress is a web-based trading platform designed with the most demanding trader’s needs in mind.

Iress is a comprehensive trading platform with advanced functionalities designed to meet even the most advanced trader’s demands. With Iress, traders can manage multiple portfolios and benefit from real-price streaming. By combining access to full market depth, and an enhanced in-house charting system with live news flows, Iress provides the assets you need to maintain your edge in the market.

Trade Shares CFDs on Mottai, the compelling trading platform choice for Australian traders.

Launched in 2024, the Mottai trading platform is the result of the collaboration of FP Markets with FlexTrade Systems. Mottai is a multi-asset trading platform developed to offer high-speed execution speed and customisation to help simplify trading workflows. Mottai’s user interface has been designed with the traders’ needs in mind, allowing them to focus on their strategies’ important elements. The Mottai trading platform removes the unnecessary distracting noise and helps you evolve as a trader.

By registering, you agree to FP Markets’ Privacy Policy and consent to receiving marketing materials from FP Markets in the future. You can unsubscribe at any time.

Quick Start & Resources

Markets

Tools & Platforms

Trading Info

About us

Regulation & Licences